Fha 203k loan bad credit

Va Loan Requirements For Sellers. Buying A Home In A Sellers Market With Bad Credit.

The 203k Loan What It Is How It Works How You Can Get One Home Improvement Loans Renovation Loans Home Renovation Loan

The most common loan type for bad credit borrowers is an FHA loan.

. One of the most important aspects of a VA loan for the seller to keep in mind is the inspection appraisal process. One point costs 1 percent of your loan amount and lowers your rate by 025 percent. Despite that some loans like balloon loans are not fully amortizing -- meaning that.

Rates requirements credit score eligibility and benefits. Estimate the cost of your project. The two acts were merged together on October 3rd 2015 under the TILA-RESPA Integrated Disclosures rule TRID or TILA-RESPA Initiative.

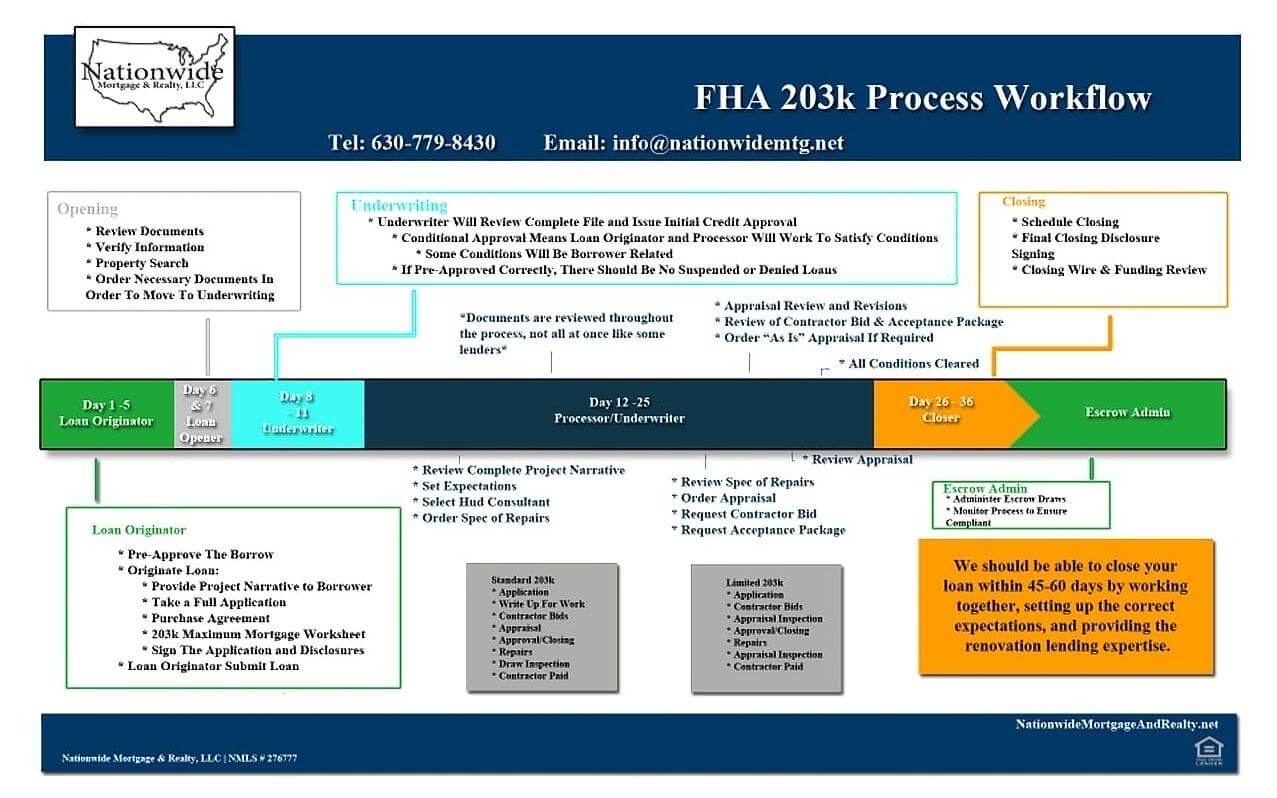

The FHA 203k Loan Process. To qualify for a 35 down payment FHA-insured mortgage loan the minimum credit score required is 580. How Much Will You Pay in VA Loan Fees.

A Complete Guide to Rural Development Loans Recent. However to qualify for a conventional loan the loan applicant needs a minimum credit score of at least 620. There are good points and bad points to the loan and all of these should be considered before making a.

In this guide on buying a home in a sellers market. Earn A Higher Credit Score in 8 Steps How to Build Credit in 10 Steps VA Loan Closing Costs. See all Mortgage Learning Center.

If either of these comes back negative then it could mean difficulty in the buyer securing the loan. Loan is 35 if your credit score is 580 or higher. An FHA 203k loan helps you buy a fixer-upper or renovate your current home.

Although they were pre-approved for regular FHA or conventional financing they most likely need to be re-approved for a 203k loan. Compare FHA loans with 35 down vs. Enforcement of the initiative falls to the Consumer Financial Protection Bureau CFPB which was founded back in in 2011The disclosures of today come in two simple forms for easier consumer understanding.

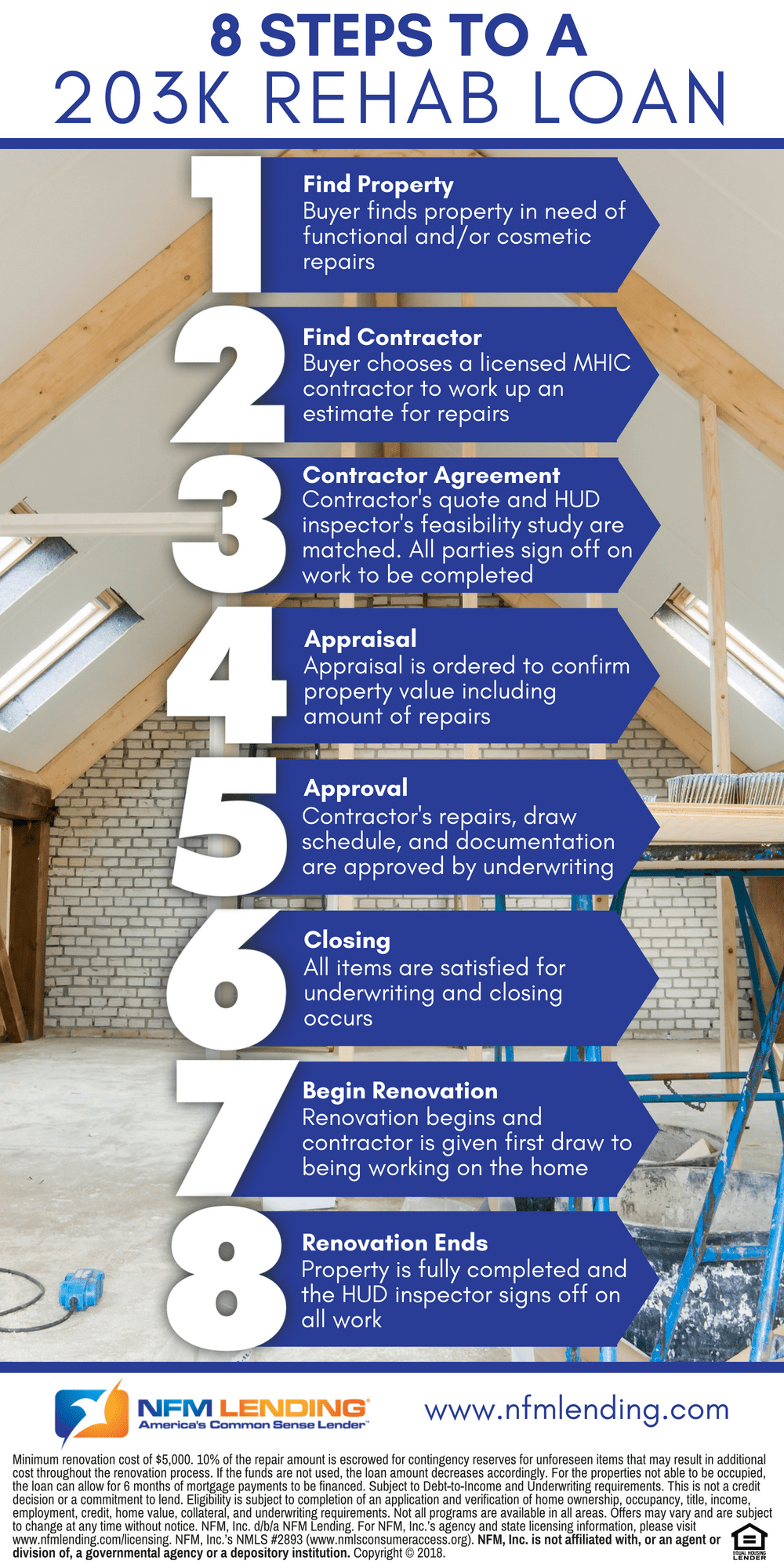

September 12 2022 Mike Gracz. The buyer finds a home they like but its in disrepair. This inspects both the safety and integrity of your home and places a fair market value on it.

Conventional loans with 3 down. The USDA follows the same guidelines for offer letter loans as the FHA. With government backing these loans can offer more competitive rates primarily for single-family primary residences.

A Complete Guide to A Home Equity Line of. Expect to have reserves to cover an amount equal to the following. The Federal Housing Administration technically allows FICO scores between 500 and 579 with a 10 down payment.

Payments on 5-Year Balloon Loans. See if you qualify for 203k mortgage financing. The FHA 203k loan is a good way to buy a home and also get the extra money that can be used for renovations repairs or both.

When reviewing a credit report for a mortgage loan where you find derogatory credit on the credit report always find out what contributed to the derogatory credit. If your credit score doesnt qualify you for a conventional loan with low-interest rates consider an FHA loan USDA loan or VA loan. Pros and Cons of FHA 203k Loan.

Is It Youre Looking For. Conventional loan programs have higher credit standards than FHA-insured mortgage programs. At least 2-6 months worth of principal and interest payments for the new mortgage loan.

Credit score debt to income ratios and the proposed loan to value ratio for the new residence will all come into play during the loan approval. If your credit isnt great and you have little money to put down an FHA 203k loan might be best since you can get a mortgage with only 35 percent down. Heres a breakdown of the general 203k loan process.

The buyer talks to their loan professional about the FHA 203k. Loan applicants that can provide evidence that the derogatory credit was due to loss of employment or other extenuating circumstances as defined in Mortgagee Letter 2013 26 can. California FHA 203k Loans For Fixer-Upper Homes.

To receive approval for an FHA loan with an offer letter you must submit a copy of your offer letter and prove that you have sufficient reserves to cover cost obligations as well as other liabilities until you begin the job. When it comes to getting a traditional home loan most home loans are fully amortized meaning that each payment a borrower makes goes to paying off both the interest and the principalAt the end of the loan period the entire loan is paid off. What Fees Will You Pay.

Fha 203k Process Work Flow Steps To A Successful Fha 203k Loan

Fha 203k Rehab Loan What You Need To Know Home Improvement Loans Loans For Bad Credit Home Loans

8 Steps To A 203k Rehab Loan

9 Best Mortgage Lenders For Bad Credit Of 2022 Loans For Bad Credit Best Mortgage Lenders Mortgage Marketing

Your Complete Guide To Fha 203k Loans Sofi

Fha 203k Loan Requirements And Guidelines For Renovation Has The Same Qualifying Requirements As A St Home Renovation Loan Fha 203k Loan Home Improvement Loans

Tcad Trying To Make Appraisals More Equitable Austin Monitor Home Improvement Loans Fha 203k Loan Refinance Mortgage

Purchasing A Home W Fha 203k Diy Social Seo Home Renovation Loan Home Improvement Loans Loan

Five Pitfalls To Avoid When Considering A Fha 203k Loan Fha 203k Loan Fha Fha Loans

Fha Loan Limits Requirements Rates And Tips All For Free Fha Loans Home Buying Process Home Improvement Loans

Fha 203k Loans Palmetto Mortgage Of Sc Llc

Fha Vs Conventional Loan Which Mortgage Is Right For You Realtor Com Conventional Loan Fha 203k Loan Mortgage Loans

How Fha 203k Loans Work And How To Qualify Total Mortgage Blog

Fha 203k Loan Requirements And Guidelines Best Mortgage Lenders Mortgage Mortgage Interest

Bring Your Content Media To Page One Of Google Search By Becoming Our Community Lender Find Our Google Communit Content Media Loans For Bad Credit Montebello

What Is An Fha 203k Mortgage Loan Requirements For Home Renovations Mortgage Loans Business Loans Fha Loans

Pros And Cons Of Fha 203k Loan Fha 203k Loan Fha Loan